idaho sales tax rate in 2015

Average Sales Tax With Local. Non-property taxes are permitted at the local.

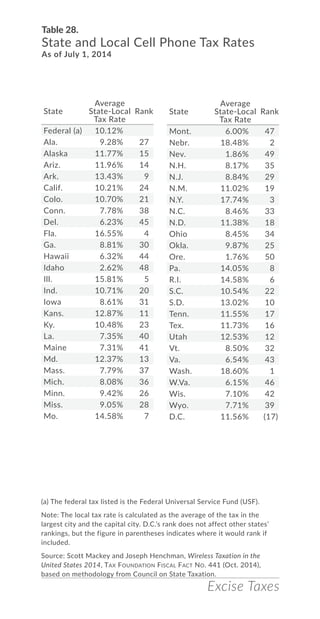

Pdf Evolution Of Excise Taxation In The Usa Since The Great Recession Boris Morozov Academia Edu

The table below summarizes sales tax rates for Idaho and neighboring states in 2015.

. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Makes more than two retail sales during any. The use tax rate is the same as the sales tax rate.

During the 1980s and early 1990s Idahos income tax structure was one of the most progressive in the United States. Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83702 83709 83712 and 83713.

Prescription Drugs are exempt from the Idaho sales tax. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. While many other states allow counties and other localities to collect a local option sales tax Idaho does.

The total tax rate might be as high as 9 depending on local municipalities. This is the total of state county and city sales tax rates. Idaho has state sales.

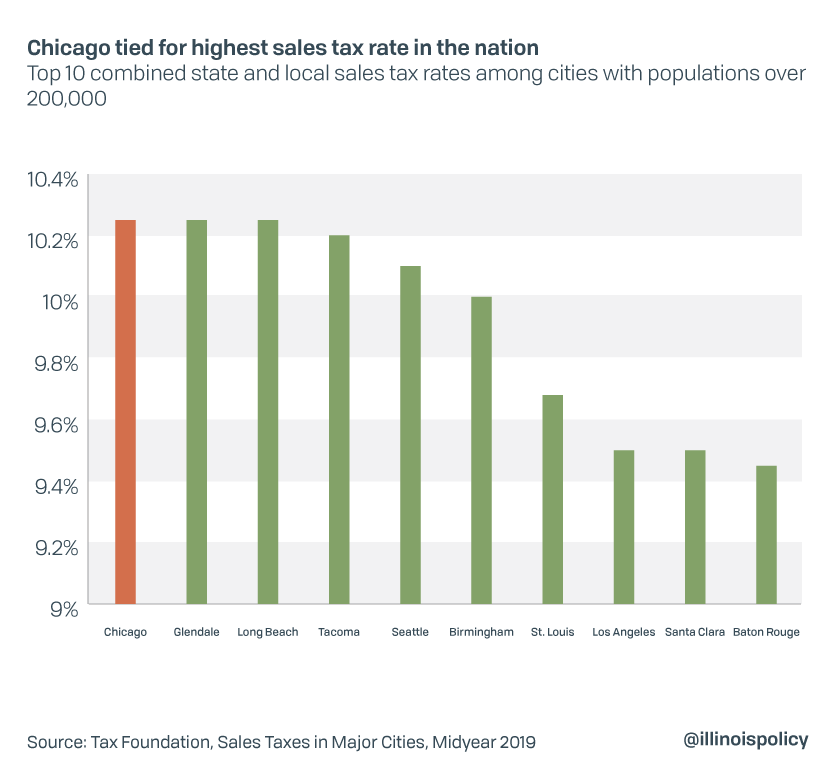

Find your pretax deductions including 401K flexible account. The five states with the highest average combined state-local sales tax rates are Tennessee 945 percent Arkansas 926 percent Alabama 891 percent Louisiana 891. A retailer is any individual business nonprofit organization or government agency that does any of the following.

The current Idaho sales tax rate is 6. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Most property tax measures.

What is the sales tax rate in Idaho Falls Idaho. Find your income exemptions. Sells to a consumer who wont resell or lease the product.

Counties and cities can charge an. An alternative sales tax rate of 6 applies in the tax region. The sales tax rate in Idaho for tax year 2015 was 6 percent.

280 rows 2022 List of Idaho Local Sales Tax Rates. Object Moved This document may be found here. How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table.

The top bracket went to 85 in the 1980s. The table also notes the states policy with. The current state sales tax rate in Idaho ID is 6.

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Sales Tax Rates By City County 2022

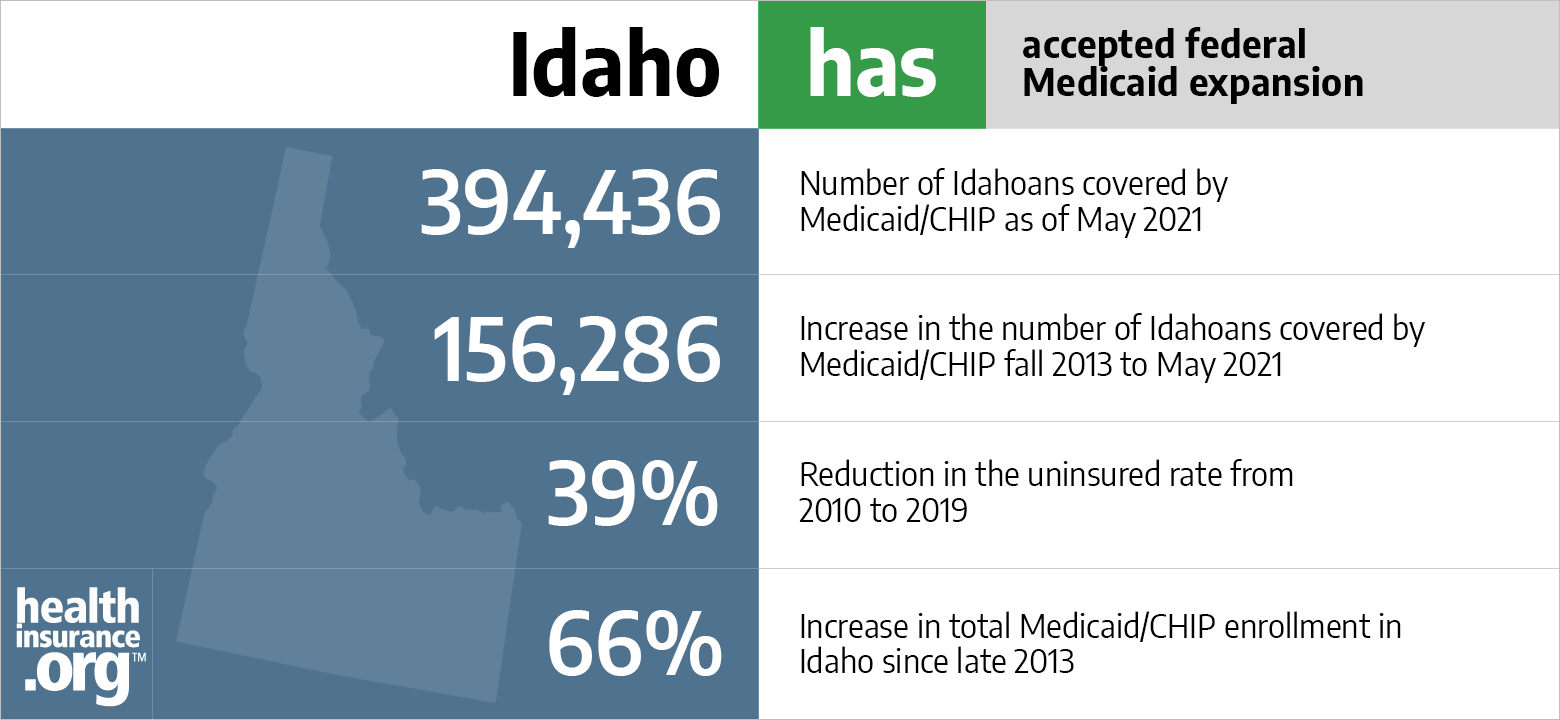

Aca Medicaid Expansion In Idaho Updated 2022 Guide Healthinsurance Org

Historical Idaho Tax Policy Information Ballotpedia

State Tax Levels In The United States Wikiwand

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Prepare And File An Amended Idaho Income Tax Return

Facts Figures 2015 How Does Your State Compare

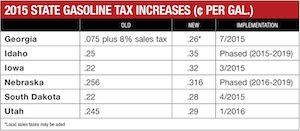

Several States Raising Gas Tax Rates 2015 05 27 Enr Engineering News Record

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Sales Tax Rate Rates Calculator Avalara

Tax Shift Of 2006 Adds Up To Tax Increase

Joyful Public Speaking From Fear To Joy Just In Time For Christmas A Bluster And Vendetta Based State Budget Proposed By A Grinch

Idaho Property Tax Shift Impacts Residential Commercial Properties

State Income Tax Brackets Charted Tax Foundation Of Hawaii