monterey county property tax due dates

On or before November 1. Web Important Dates and Deadlines Monterey County CA Skip to Main Content Contact Us A-Z Services Jobs News Calendar Residents Your Home Assessment Appeals Disaster.

Appeals of supplemental and escaped assessments must be filed within 60 days of the mailing date.

. Web Secured Property Tax Monterey County CA ShowHide COVID-19 Links COVID-19 Vaccine COVID-19 Information Page County Departments Operations During COVID-19. Web Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus. You can call the Monterey County Tax Assessors Office for.

For those who pay the tax within 30 days of the due date and do not owe back taxes on. Web The second payment is due september 1 2021. Web To calculate your property tax in Monterey county you take the.

- QR Codes. Web Monterey county property tax due dates 2021 Friday March 11 2022 Edit. Web Monterey County 31 Mar The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm.

Web Important Dates Monterey County CA Government Departments I - Z Treasurer - Tax Collector Important Dates Print Feedback Share Bookmark Font Size. Choose Option 3 to pay taxes. Web Publish notice of dates when taxes due and delinquent.

Web Monterey County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused on your. Web Treasurer - Tax Collector Monterey County CA ShowHide Skip to Main Content Home Home Go Contact Us A-Z Services Jobs News Calendar Residents Your Home. Website Design by Granicus - Connecting People and Government.

Web When contacting Monterey County about your property taxes make sure that you are contacting the correct office. Web The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property. Web Pay Property Taxes Offered by County of Monterey California customercarecomontereycau 831 755-5057 PAY NOW Search for your current.

Web Property Taxes Property Taxes Due Dates January 1 - Lien date the date taxable value is established and property taxes become a lien on the property July 1 - Beginning of the. You will need your 12. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

2nd Installment - Due February. State law says local tax collectors cannot extend the date. Web 2022 Monterey County CA.

Second installment real property taxes due and payable. Last day to file a claim for deferment of property. Web 1-800-491-8003 - Direct line to ACI Payments Inc.

Property taxes are due january 1st for the previous year. Web Monterey County calculates the property tax due based on the fair market value of the home or property in question as determined by the Monterey County Property Tax. Web Monterey County property taxes still due on Friday.

Web Monterey county property tax due dates 2021 Friday March 11 2022 Edit.

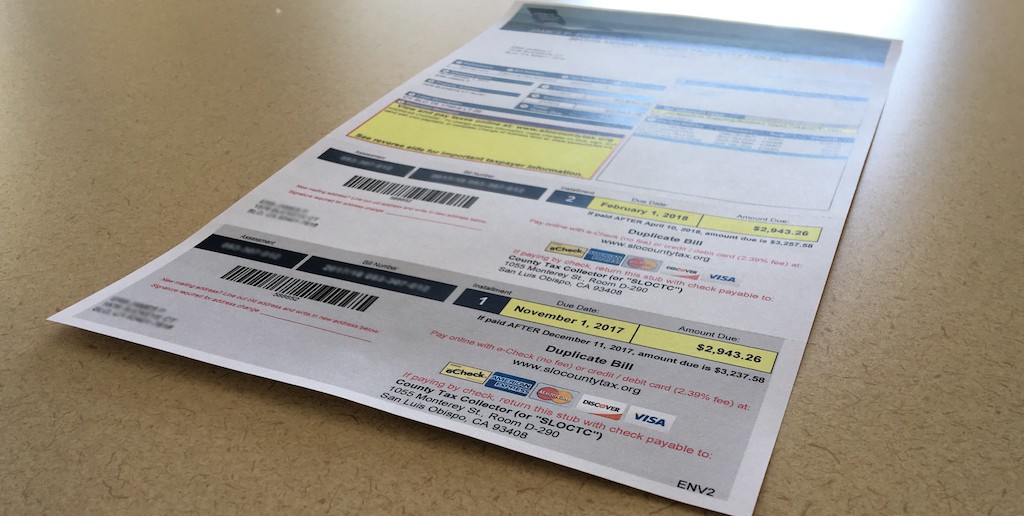

Pay Taxes On Unsecured Property By August 31st To Avoid Penalties County Of San Luis Obispo

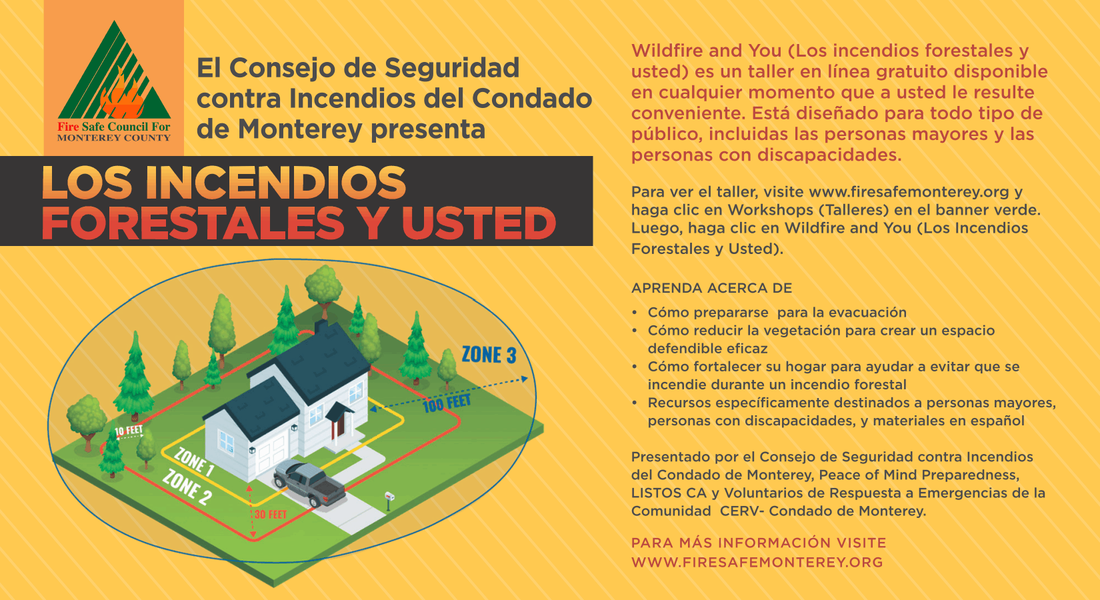

Fire Safe Council For Monterey County Home

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Monterey Peninsula Unified School District

Monterey County Property Tax Guide Assessor Collector Records Search More

![]()

Monterey County Property Tax Guide Assessor Collector Records Search More

Monterey County Gives Your Gift Goes Further Now

Vita Free Tax Prep Service United Way Monterey County

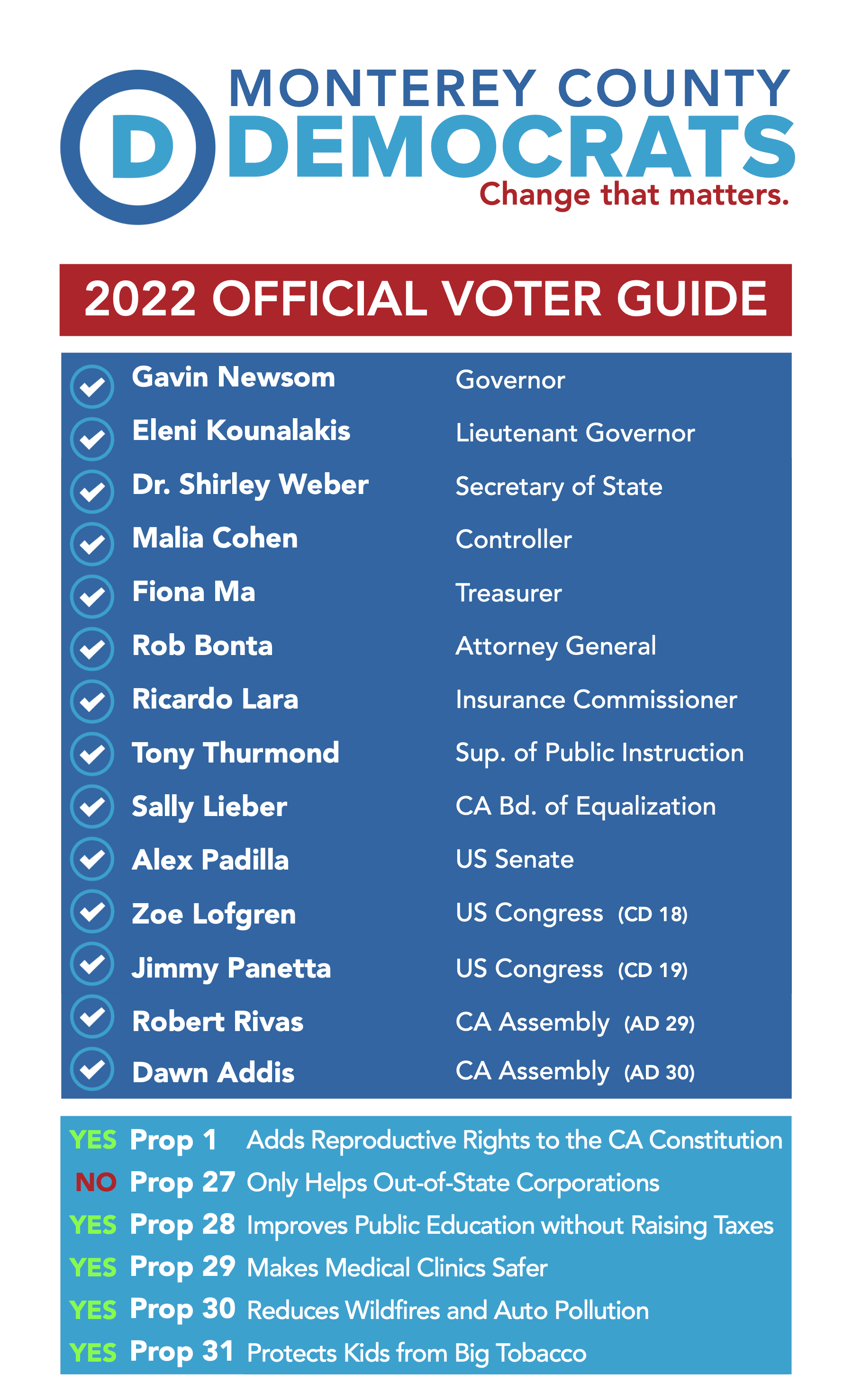

Voter Guide Monterey County Democrats

Calfresh Monterey County 2022 Guide California Food Stamps Help

Career Technical Education Career Technical Education Department

Monterey County California Ban On Oil And Gas Drilling Measure Z November 2016 Ballotpedia

Slo County To Waive Penalties For Late April Property Taxes Slo The Virus

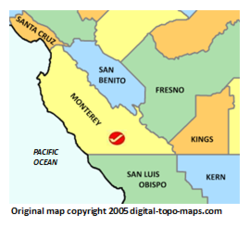

Monterey County California Genealogy Familysearch

Small Business Grants Monterey County Workforce Development Board